22.02.2021

10 minutes of reading

Transport / DASHBOARD ISSUE 16 - The year 2020 and Outlook

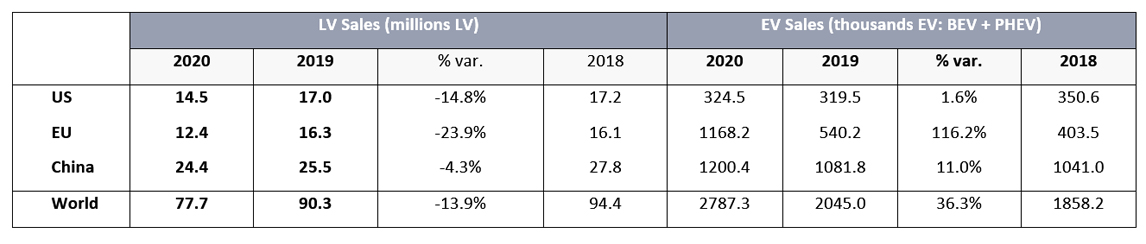

In a global car market in steep decline (-14%), sales of electric vehicles increased last year by +36%. Given the latest commitments made by car manufacturers and governments to develop electric vehicles, 2020 was a pivotal year heralding the beginning of a major change in the global vehicle fleet. Any return to “the old days” or status quo now seems totally unimaginable.

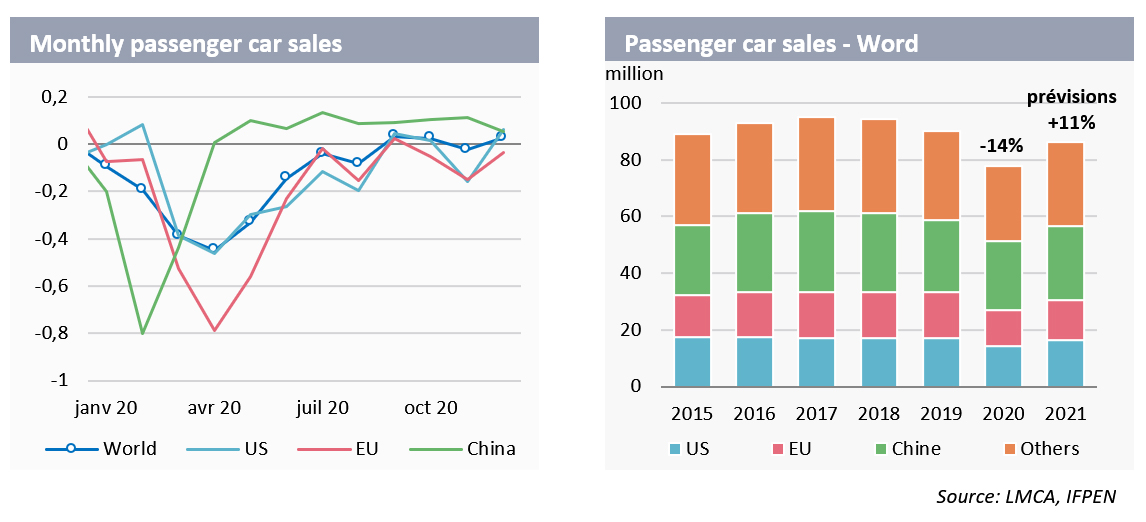

A global car market on a roller coaster

At the height of the COVID-19 crisis, global sales of private vehicles (PV) fell by 45% on a year-on-year basis in April, before recovering rapidly in the third quarter only to plunge again in the fourth quarter as a result of a resurgence in COVID cases and the introduction of new lockdown measures in many regions of the world. In 2020, it is estimated that total private vehicle (PV) sales fell by 14% to 77.7 million vehicles.

For 2021, it is estimated that global sales should bounce back by +11% to 86.2 million vehicles, nevertheless still 5% below the level seen in 2019. A more robust recovery in demand seems unlikely given existing fears concerning the evolution of the health situation and the time required for the implementation of vaccination campaigns.

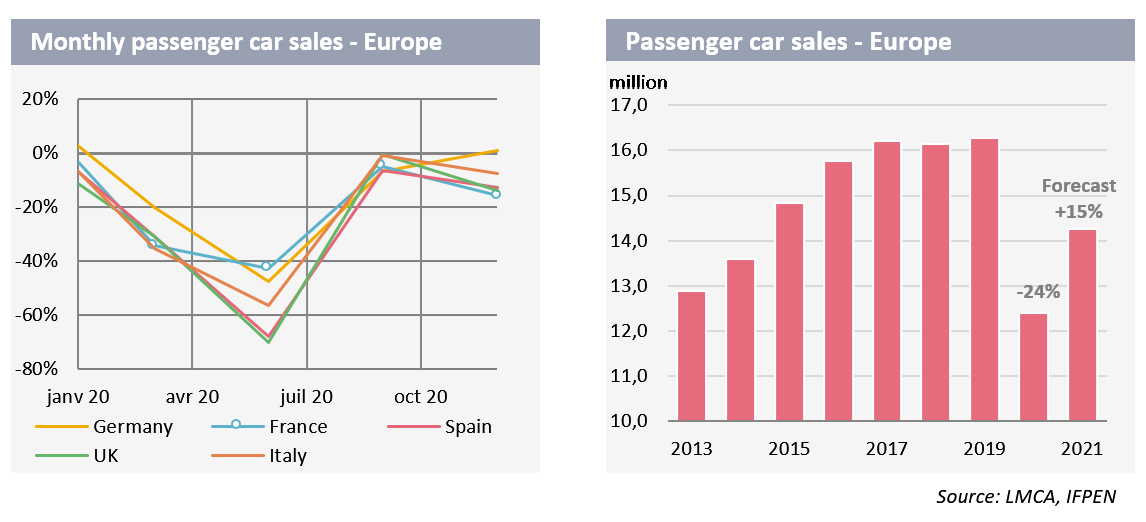

Europe: Partial recovery in 2021. Tightening up of emission regulations

PV sales fell sharply in Europe, where lockdown measures were the strictest anywhere. The introduction of a raft of measures to support the car industry (government-backed loans, purchase incentives, conversion premiums, etc.) along with numerous promotions offered by manufacturers helped support sales during the summer of 2020 but a new wave of COVID-19 cases in the fall quashed any hope of a recovery, with total annual sales falling by 24%.

In 2021, there should be an upturn in sales of +15% to 14.3 million vehicles, provided that lockdown measures remain limited to the first quarter and supply problems relating to some materials and components (such as semiconductors), signaled by several car manufacturers, do not hamper production plans. However, despite this solid recovery, sales will remain 12% below levels seen in 2019. A return to pre-crisis levels is not expected before 2023.

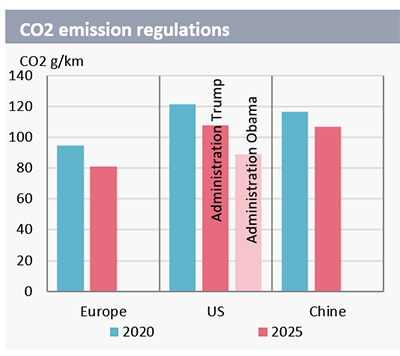

In 2020, the first phase of the new European regulations targeting CO2 emission came into force with an emission objective for each manufacturer set at 95 g/km, applying to 95% of their least-emitting new cars.

From 2021, the average emissions of all manufacturers’ newly registered cars must comply with European objectives. The emissions of the European new vehicle fleet are not yet known (the Commission’s report is generally published in June) but preliminary analyses show that emissions are set to fall from 122 g/km in 2019 to 107 g/km. It is unlikely that the 95 g/km target will be met, since energy efficiency improvements and new technologies introduced by manufacturers have been offset by the production of larger vehicles, the reduction in diesel vehicle registrations (the share of diesel vehicle sales fell to below 24% in December) and the increase in the number of SUVs on the road.

However, the situation is very different for individual manufacturers concerning, in particular, the counting of “super credits”. This system of regulatory flexibility gives manufacturers a credit of up to 7.5 g/km for the sale of electric or ultra-low emission (<50 g/km) vehicles and enables them to count these vehicles twice. According to a Transport & Environment study, half of the reduction in CO2 emissions in 2020 may have been due to the use of these “supers credits”. While many manufacturers met their targets by combining their sales with those of other manufacturers, Ford-Volvo, FCA (Fiat Chrysler)-Tesla-Honda, Daimler and Volkswagen Group are not thought to have met the target set for 2020.

For 2021, as regulations tighten (average emissions applied to all sales, reduction in super credits), manufacturers will be employing a two-pronged strategy: to accelerate sales of electric and hybrid vehicles while at the same time reinforcing emission pooling with other manufacturers to combine their production with that of a less-polluting counterpart. For example, Volkswagen has joined forces with Chinese manufacturer SAIC (MG in Europe) for its CO2 credits for the period 2020-2022, and, prior to its merger with PSA, FCA purchased credits from Tesla. The sale of emissions credits may also represent an additional source of income for some manufacturers. At the end of 2020, Renault, leading the way in European all-electric private vehicle registrations and hitherto in a CO2 pool with Mitsubishi and Nissan, announced its intention to open up a CO2 pool to other manufacturers.

Finally, in 2021, the European Commission is set to vote on the future Euro 7 standard, scheduled to come into force in around 2025. According to information currently available, the limits likely to be introduced for NOx are 30 mg/km (compared to 60 in gasoline and 80 in diesel with Euro 6) and 100 to 300 mg/km for CO (vs 500 and 1,000 currently). The Commission is also set to introduce stricter compliance coefficients relating to real driving emissions (RDE) tests. According to various sources, Euro 7 may also include other pollutants such as ammonia (NH3), ultra-fine particles (the target for the number of fine particles looks set to be reduced to 10 nm compared to 23 nm currently with Euro 6), nitrous oxide (N2O) and even particles emitted by brakes. Also, for the first time, Euro 7 is set to fix the same pollution thresholds for both gasoline and diesel engines. The arrival of Euro 7 should thus act as a further springboard for the electric vehicle.

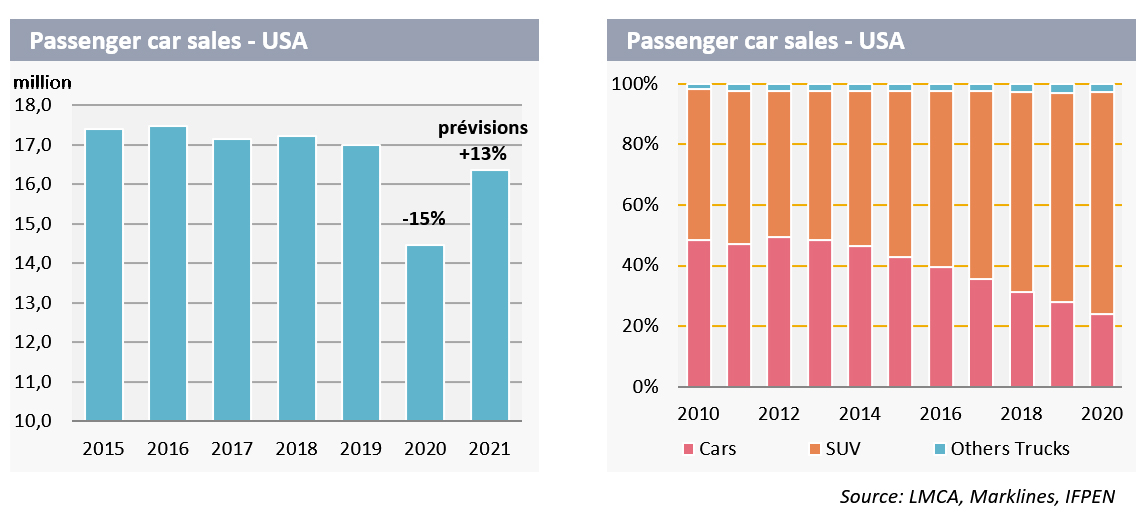

USA: a relatively resilient vehicle market throughout the crisis

In the USA, it is estimated that PV sales fell by 15% to 14.5 million in 2020, taking sales to their lowest level since 2012. With sales outlets remaining open in many states and the development of online sales, the fall was less marked than in other regions across the world. The market also recovered well at the end of the year, with sales rising by +6.4% in December. Despite the crisis, SUV sales resisted relatively well, showing a fall of -10% compared to -27% for light vehicles. Almost 3 out of 4 vehicles sold in 2020 (73%) were SUVs.

In 2021, sales are set to increase by +13%, to 16.3 million vehicles, thanks, in particular, to the reforms contained in the economic plan set out by Joe Biden’s new administration. However, as in Europe and China, evolving regulations targeting vehicle emissions could ultimately alter the American car industry landscape. In 2012, the Obama administration had set a new vehicle CO2 emissions objective of 88.9 g/km for 2025. This objective was revised by the Trump administration, with a new target of 108 g/km set for 2026 (SAFE regulation). Given the new president’s climate commitments, it is highly probable that these targets will be further revised and aligned with those of Europe (where the target is 81 g/km by 2025). If the decision were to be taken to reintroduce the targets of the Obama administration, this would result in a tightening up of standards by more than 18%, which would have a major impact on manufacturers and would be likely to act as a significant stimulus for electric vehicle sales (BEV and PHEV). It should be noted that in California several manufacturers, including Ford, Honda, VW/Audi, BMW, and Volvo Car, have proactively committed to reducing their emissions by 12% in some vehicle categories.

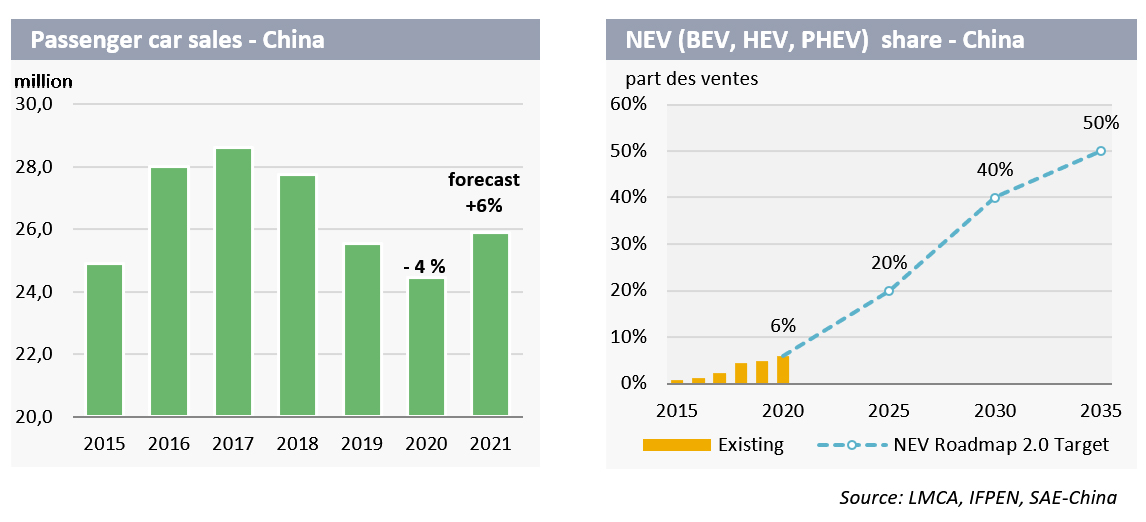

China: increasing drive towards new-energy cars

In China, the first country to be affected by the pandemic, PV sales fell by 43% in the first quarter of 2020 before recovering rapidly to end the year down by just 4%. This recovery was particularly marked for new-energy vehicles (NEV: BEV+PHEV+FCEV), which are driving vehicle sales.

At the end of 2020, China was due to cut subsidies for NEVs, that had previously been benefitting from a dual mechanism of subsidies and credits (NEV credits required to sell cars in the local market). In the face of falling vehicle sales and the significant drop in electric vehicle sales in the 1st half of 2020, the Chinese government decided to extend subsidies until the end of 2022.

In 2021, the Chinese car market is set to grow by 6% to 25.9 million vehicles, following three years of contraction. The outlook for next year however remains challenging, in a context marked by considerable uncertainties concerning the economic recovery and the management of the health crisis, with a resurgence of COVID cases in China and some Asian countries. In the longer term, China’s objective is to continue to develop NEV sales and improve its emissions standards. At the end of 2020, the Society of Automotive Engineers of China (SAE-China), published a roadmap for the car sector for the period out to 2035, with an objective for NEV penetration of 50% of sales by 2035, the total conversion from IC engine vehicles to hybrid vehicles and a consumption objective of 4.0 l/100 km.

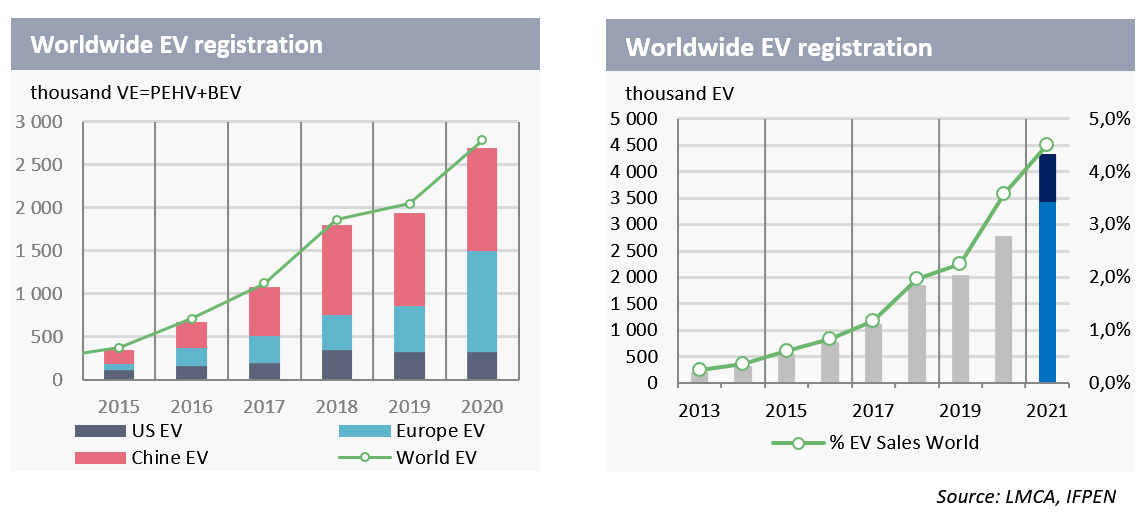

Global EV market: no COVID effect- Europe and China gather momentum

Despite the economic and health crises and a decline in sales in the first half of the year, EV sales in 2020 reached nearly 2.8 million, an increase of +36%. This considerable resilience of the electric segment can mainly be explained by the recovery and support plans, aimed at the car sector in general but which have primarily been of benefit to electric vehicles and enabled EV sales to exceed 3.6% of global light vehicle sales.

The EV fleet now represents 9.5 million vehicles. For 2021, we estimate sales will be between 3.4 and 4.3 million, as a function of uncertainties concerning the evolving health situation, particularly in the first half of the year. Given the evolution of PV sales, the share of EV should be somewhere in the 4.5-5.0% range.

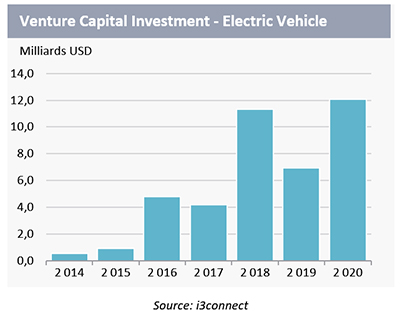

The electric vehicle sector continues to pull in players from the world of finance and venture capital. Despite the economic crisis, the amounts invested in 2020 in the electric vehicle sector exceeded 12 billion dollars. In 2020, the star of the show when it comes to raising capital was Rivian, a start-up company established in 2009 specializing in electric vehicles. It raised more than 2.5 billion dollars (1.3 billion in 2019) thanks to financial support provided by some high-profile investors: Blackrock, Soros Fund Management LLC, T. Rowe Price, Fidelity, Ford Motors and Amazon (which ordered more than 100,000 delivery vehicles).

Doubling of EV sales in Europe

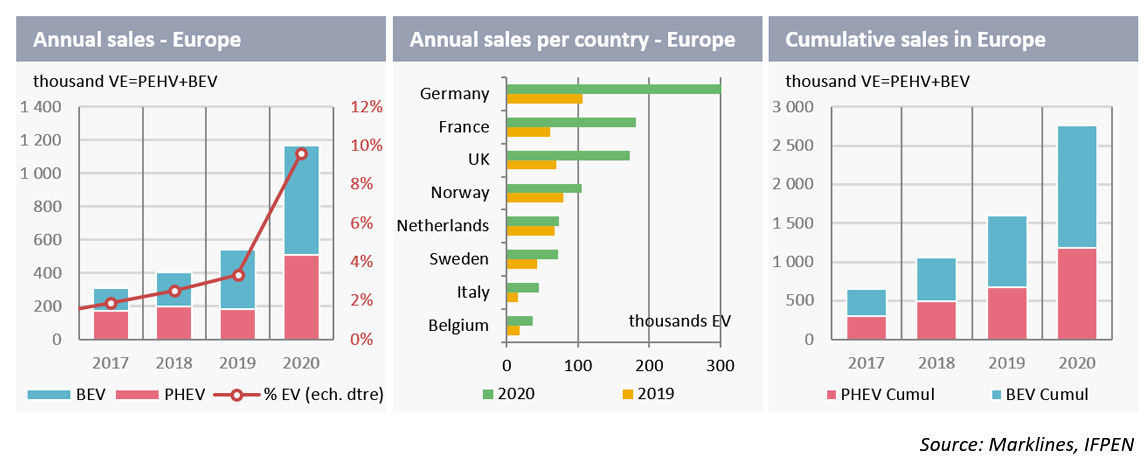

The increase in EV sales in Europe was remarkable: sales doubled to reach 1.1 million vehicles and a record market share of 9.6%. In total, the European fleet totaled 2.8 million EVs, making Europe the world’s second biggest electric vehicle market behind China (4.4 million). EV sales increased by +85%, thanks to a significant rise in the sale of PHEVs, with sales almost tripling to 506,000 units. This trend is set to continue in the next few years, with PHEVs fully playing their role as a transition technology to meet CO2 emission requirements (when they are used in electric mode wherever possible).

The strong increase in sales can principally be explained by new European regulations encouraging car manufacturers to market numerous PHEV and BEV models and government support initiatives with generous grants available for the purchase of electric vehicles (€7,000 in France, €9,000 in Germany, €3,350 in the UK), alongside additional mechanisms (scrappage scheme, conversion premium, VAT reduction, etc.)

In terms of models, three all-electric cars led sales in 2020: Renault’s ZOE with more than 98,000 units sold in Europe, followed by Tesla’s Model 3 (79,000) and Volkswagen’s ID.3 (51,000), which had a very successful market launch.

In terms of countries, Germany led the field with 350,000 vehicles sold, followed by France (182,000) and the United Kingdom (175,000). Unlike many other European countries, Germany maintained generous subsidies for plug-in hybrid vehicles (around 6-7,000 euros depending on the vehicles), which accounts for almost 52% of electric vehicle sales.

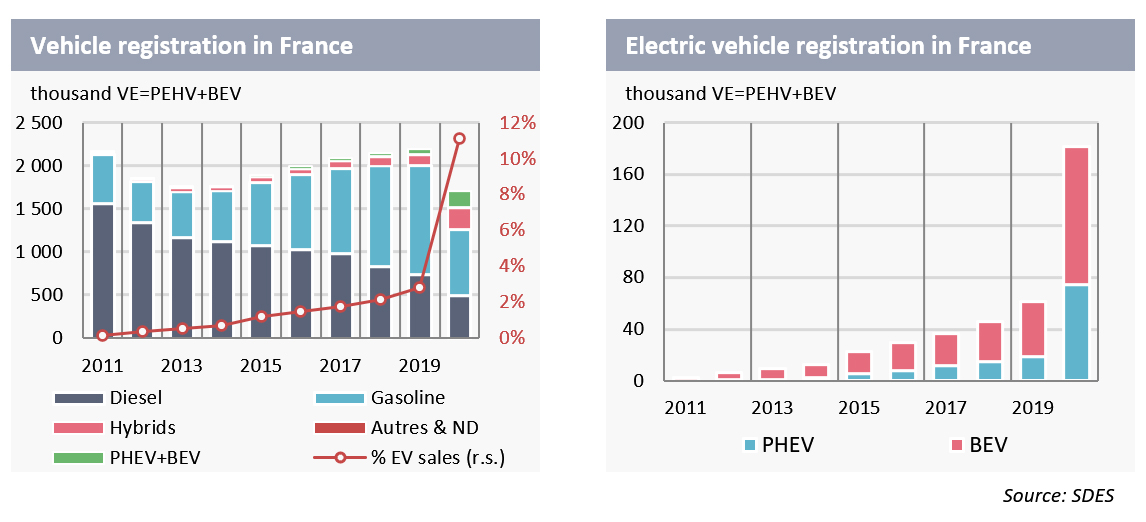

In France, according to figures published by the French Ministry for the Ecological Transition, electric vehicle sales trebled in 2020, to reach 181,526 units. The increase was even more remarkable for PHEVs, with a quadrupling of sales (to 74,224 units). Overall, the EV share in 2020 reached a record 11%.

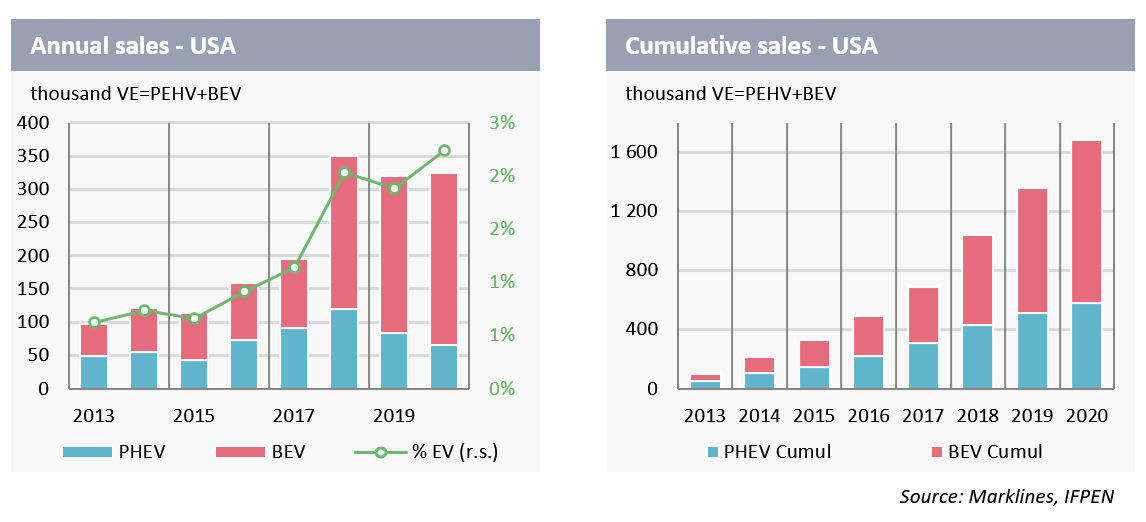

USA: weak EV growth – Joe Biden’s recovery plan

In 2020, sales of EVs in the USA only increased by 2% with 325,000 units sold, representing 2% of total sales. The American market continues to be dominated by BEVs with 80% of sales. With its Model 3 and Model Y vehicles, Tesla is by far the leading manufacturer with more than 63% of the market, followed by GM with a market share of just 6%. At the end of 2020, there were 1.7 million VEs on the road, of which 44% were Tesla cars.

However, Tesla’s dominant position in the American market may soon be challenged by the competition. American car manufacturers appear to be ready to shift their strategies to take advantage of the environmental plan introduced by a new American administration keen to drive electric vehicle sales. President Joe Biden has already signed a decree aimed at converting the federal fleet of around 645,000 vehicles to electricity. He has also committed to developing charging stations for electric cars, reviewing and extending tax credits for electric vehicles and reinforcing fuel economy standards for gasoline vehicles.

In mid-January, the first manufacturer to react to these announcements, General Motors (GM), stated its ambition to only sell zero-emission light vehicles by 2035 and to become a carbon-neutral company in its global products and operations by 2040. A veritable challenge, bearing in mind that in 2020, GM sold 222,000 electric vehicles worldwide, i.e., 3% of its sales, of which just 20,000 in the USA.

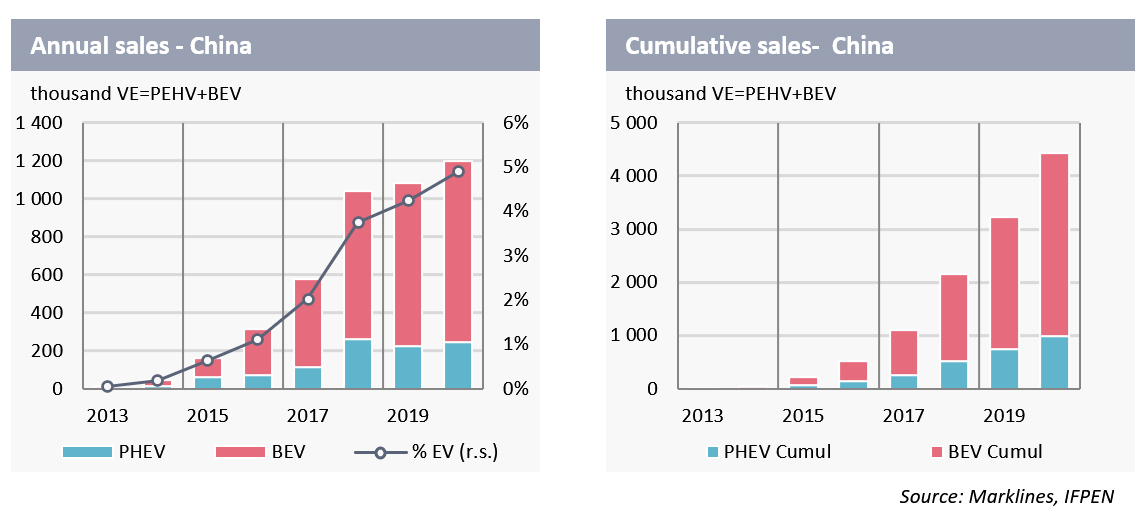

In China, having fallen by 43% in the first half of the year due to the health crisis and the economic slowdown, EV sales surged 74% in the second half. Overall, EV sales increased by 11% over the year to reach 1.2 million vehicles, i.e., almost 5% of vehicle sales. PHEV sales also rose, but the Chinese market remains primarily a market for vehicles with electric engines, the latter accounting for 80% of sales over the year. At the end of 2020, the EV fleet in China was estimated at 4.4 million vehicles, including 3.4 million BEVs.

In 2020, the best-selling car was the Wuling Mini EV (GM Group), a small urban car, priced at under €4,000. More than 126,000 units of this car were sold, ahead of Tesla’s Model 3 (121,400). With an economic recovery expected in 2021, the continuation of subsidies and increasing restrictions placed on IC vehicles in major towns and cities, the government’s 20% NEV sales target set for 2025 seems realistic.

It should be noted that in China the Battery As a Service system was relaunched by NIO, which announced half a million battery swaps in two years in more than 177 stations and a target of 500 stations by the end of the year. This solution, which has been studied and then abandoned in a number of countries, seems to have enjoyed real success and meets a demand in a country where there are few individual garages.

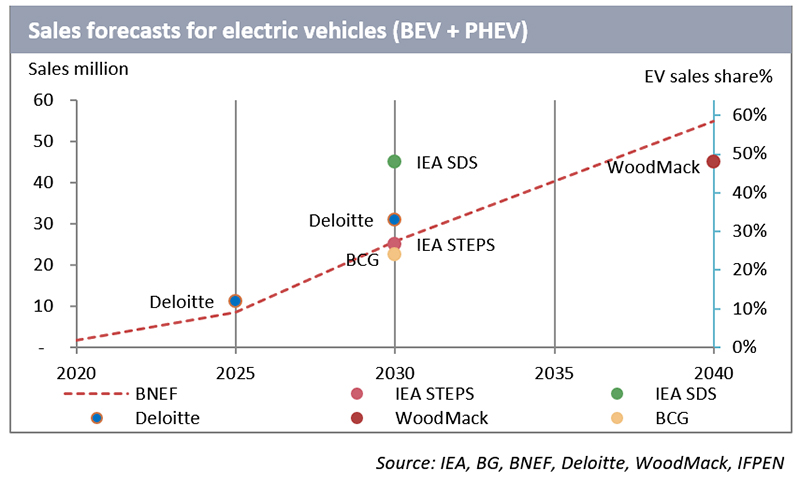

Electric vehicle fleet development scenarios

The scenarios published by the International Energy Agency (IEA) and several consultants (BCG, BNEF, Deloitte, WoodMackenzie) tend to progressively converge towards 25-30 million EVs sold in 2030 (i.e., a total EV sales share of just under 30%). The highest scenario remains that of the IEA, namely the “Sustainable Development Scenario” (SDS) with 45 million EVs in 2030 (N.B.: this scenario assumes the significant development of renewable energies in order to achieve all the objectives of the energy transition, including those set out in the Paris Agreement).

On a global scale, according to the various scenarios, the evolution of EV sales is likely to be broken down into three phases:

- an acceleration phase between 2020 and 2025, with an average annual sales growth of around 30%. During this period, subsidies for the purchase of electric vehicles and stricter regulations targeting greenhouse gas-emitting vehicles will be the principal levers diving the growth of the electric vehicle fleet. The marketing of numerous electric models with superior technical characteristics (particularly in terms of range) should also make these vehicles more acceptable to consumers. Lastly, by the end of the period, it is estimated that the price of batteries should drop below $100/kWh (currently the cost of the battery is around $190/kWh), which should make EVs a competitive option.

- a phase of sustained increases out to 2030 with annual sales growth of 20%. During this period, subsidies for the purchase of EVs will be scrapped. Sales will be primarily driven by economic factors (TCO).

- thirdly, from 2030, EV sales will slow between 2030 and 2040, with an annual growth rate of around 7%. The introduction of regulations banning gasoline and diesel vehicles in some towns and cities will become effective. At the end of the period, the share of sales may reach 50%, i.e., an EV share within the overall fleet of around 25-30%.

Europe and China should continue to dominate the global electric vehicle market. The evolution of the American EV market is more uncertain. Many analysts believe the USA is likely to be the slowest to go electric, due to the relatively low cost of fossil fuels (few taxes) and a marked consumer appetite for big cars and SUVs.

Alternative Fuels: Hydrogen and Biofuels

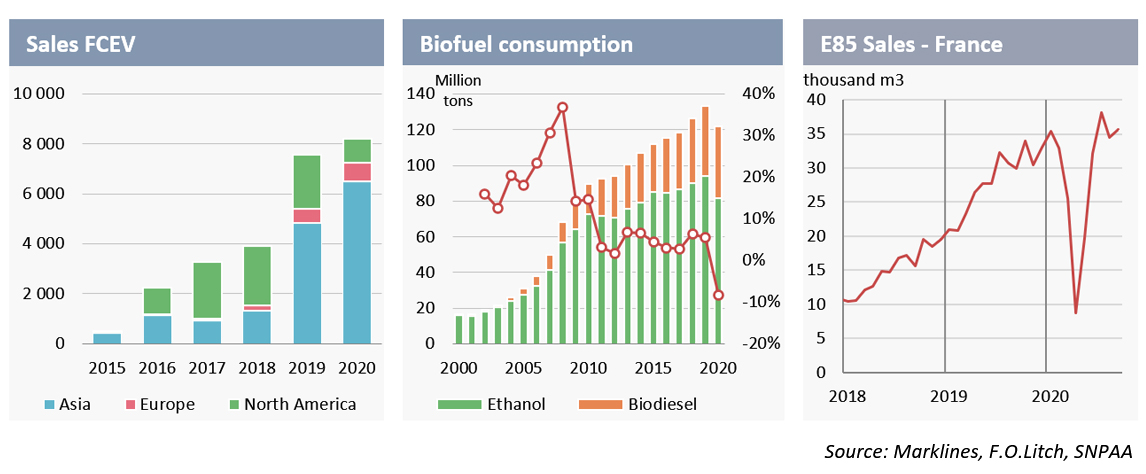

Global sales of private fuel cell electric vehicles (FCEV) increased by 8% to 8,200 units in 2020, with sales in the USA falling sharply. In 2020, within the framework of the post-COVID 19 economic recovery plan, several European countries and Europe published their strategy for the development of hydrogen as an important vector for the decarbonization of the energy system. In the transport sector, the European plan sets out measures to adopt hydrogen for captive uses, such as local urban buses, commercial fleets (taxis, for example) and some sections of the rail network that cannot be electrified, as well as in heavy-duty road vehicles. The use of fuel cells for private vehicles is thus set to remain a secondary market.

According to the most optimistic scenario (BNEF), the FCEV share could reach 1% in 2035 (857,000 vehicles). By 2040, BNEF estimates there will be 15 million private FCEVs, i.e., 1% of the vehicle fleet. In France, the Hulot plan targeted 5,000 light utility vehicles by 2023 and between 20,000 and 50,000 by 2028. For heavy vehicles, the objective was to reach between 800 and 2,000 vehicles by 2028.

The consumption of biofuels (ethanol and biodiesel) fell by around 8% in 2020, due to the decrease in the consumption of road fuel as a result of the pandemic. The increase in biodiesel incorporation requirements in several countries meant the fall in consumption was limited to 2%. In France, given its attractive price (€0.65/l on average), sales of E85 (gasoline with a bioethanol content of between 65% and 85%) jumped by +85% in 2019, representing around 3% of gasoline sales. In 2020, sales collapsed in the first half of the year due to lockdown measures, but recovered well thereafter (over the first 9 months of the year, sales of E85 increased by +10%).

In 2021, the demand for biofuels looks set to recover, while remaining below pre-crisis levels. Nevertheless, the USA rejoining the Paris Agreement and emission reduction targets in Europe may lead to new investments and create new outlets for biofuels (principally 2G), particularly in the aviation and maritime sectors. Biodiesel (Fatty Acid Methyl Ester (FAME) and renewable diesel) should continue to grow at a sustained rate in 2021 due to the expected economic recovery, the increase in incorporation requirements and the commitments made by companies to decarbonize their activities, but the growth rate is likely to remain below the high levels observed at the end of 2010 (10% per year).

Historic fall in fossil fuel consumption

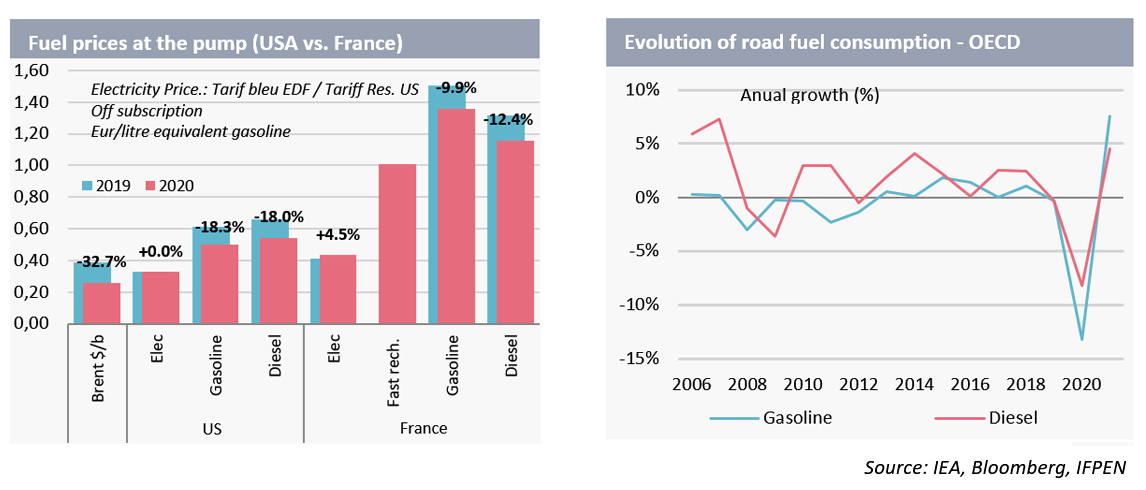

According to the latest IEA statistics, the consumption of road fuel (gasoline + diesel) in OECD countries fell by 11% in 2020. The fall was more pronounced for gasoline (-13%) than for diesel fuel (-8%), with freight activity having been less affected by lockdown measures and traffic restrictions introduced during the pandemic. For 2021, the Agency forecasts a recovery in road fuel consumption of +6% to 24.5 mb/d, similar to the consumption observed in 2014.

On the international market, Brent crude oil price fell by 33% in 2020, to 43.2 dollars per barrel. The impact on gasoline and diesel prices at the pump was -17% in the USA and -10% and -12% respectively for gasoline and diesel in France. The price of electricity (state-regulated “tarif bleu” for the residential sector) increased by +4.5% to 15.89 centimes/kWh. In terms of gasoline equivalent, the price of recharging using a domestic socket was €0.43/leq, i.e., one third of the price of gasoline or diesel, including taxes.