07.01.2021

10 minutes of reading

The results of the work carried out by IFPEN's Economics and Environmental Assessment Department have highlighted the lack of geological criticality linked to the consumption of rare earths. If there are sufficient resources to cover future needs related to the development of low-carbon technologies, why is there so much talk about this group of metals?

Rare earths, “vitamins of modern society”

Where can rare earths be found? Who produces them?

Why is there so much talk about rare earths?

Rare earths and the environment: what might China consider?

Points to remember: all the key elements about rare earths in a video

Podcast (French version)

Rare earths, “vitamins of modern society”

Rare earths refer to a set of 17 chemical elements (scandium, yttrium and the fifteen lanthanides). Contrary to what their name seems to indicate, rare earths are no more rare than other more common metals: their concentration in the earth's crust is, for example, higher than that of gold or silver and similar to that of copper or zinc.

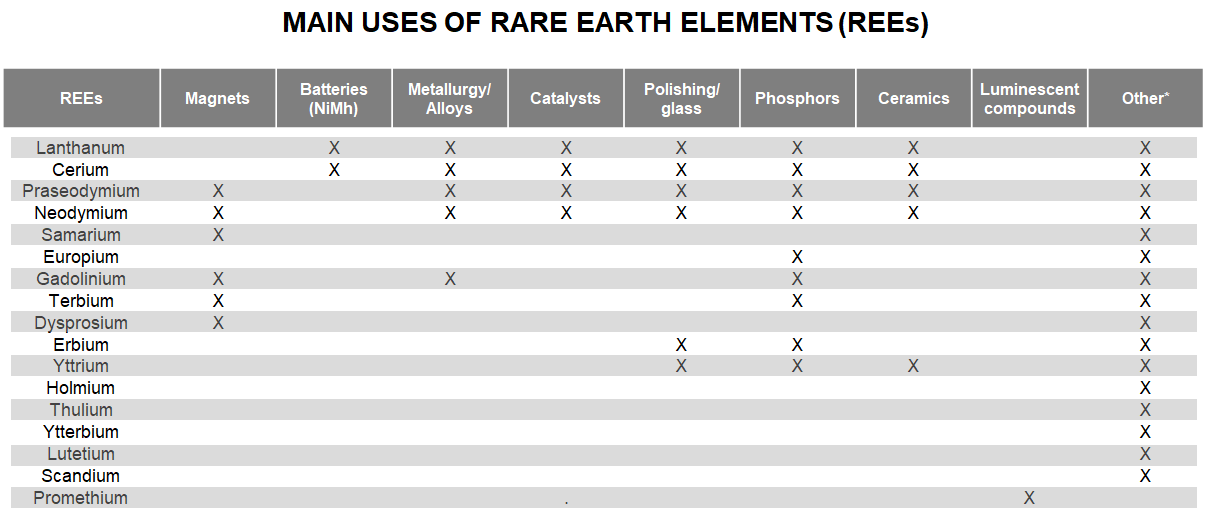

Nicknamed "vitamins of modern society", they have become an essential element for many high-tech industries (especially the military) and low-carbon technologies (magnets in wind turbines). Indeed, they have remarkable properties (high thermal stability, high electrical conductivity, strong magnetism) which have led to significant performance improvements for technologies while reducing the quantity of materials used.

*Electronic devices, audio systems, fibre optics, crystal displays, lasers, X-rays

Sources: United States Geological Survey (USGS) (2011); Du and Graedel (2011); Hart (2013); Zhou et al. (2017); Ganguli and Cook (2018)

Where can rare earths be found? Who produces them?

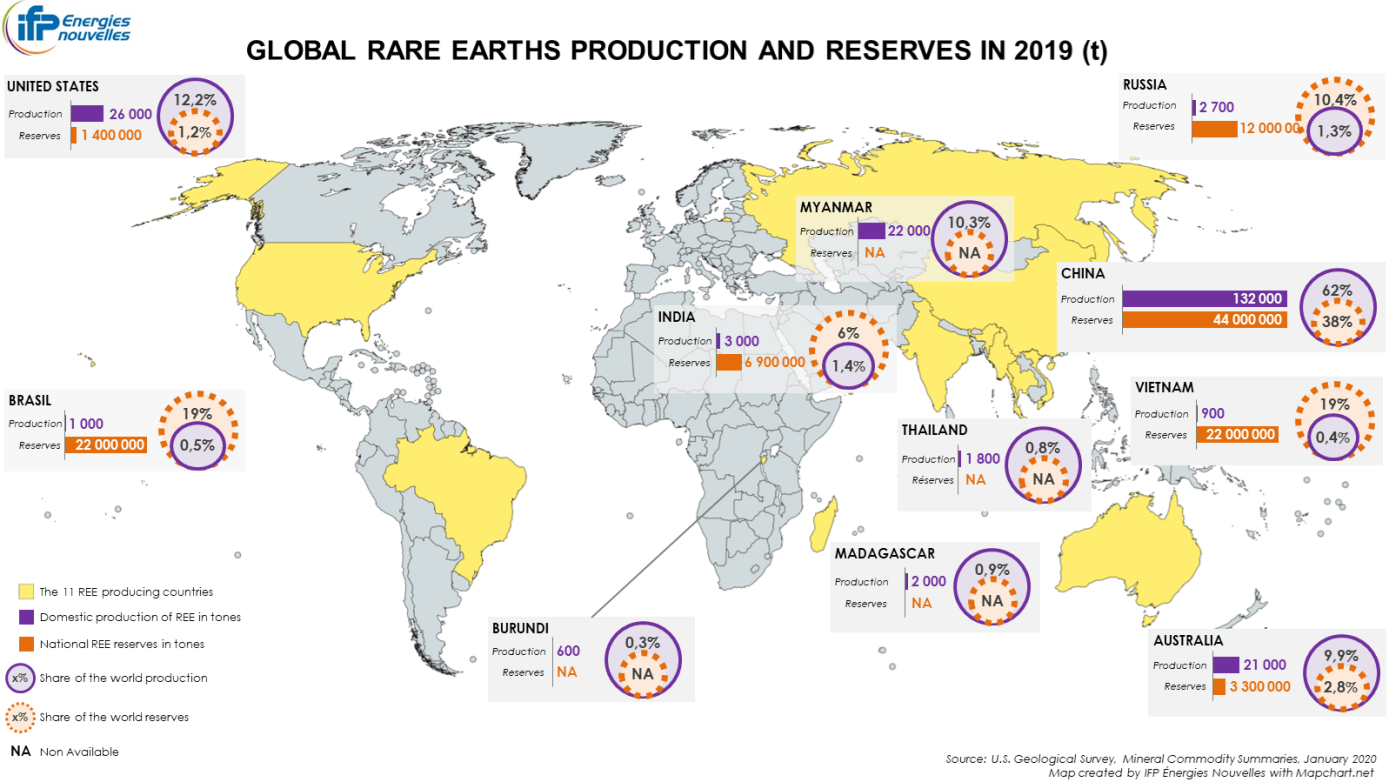

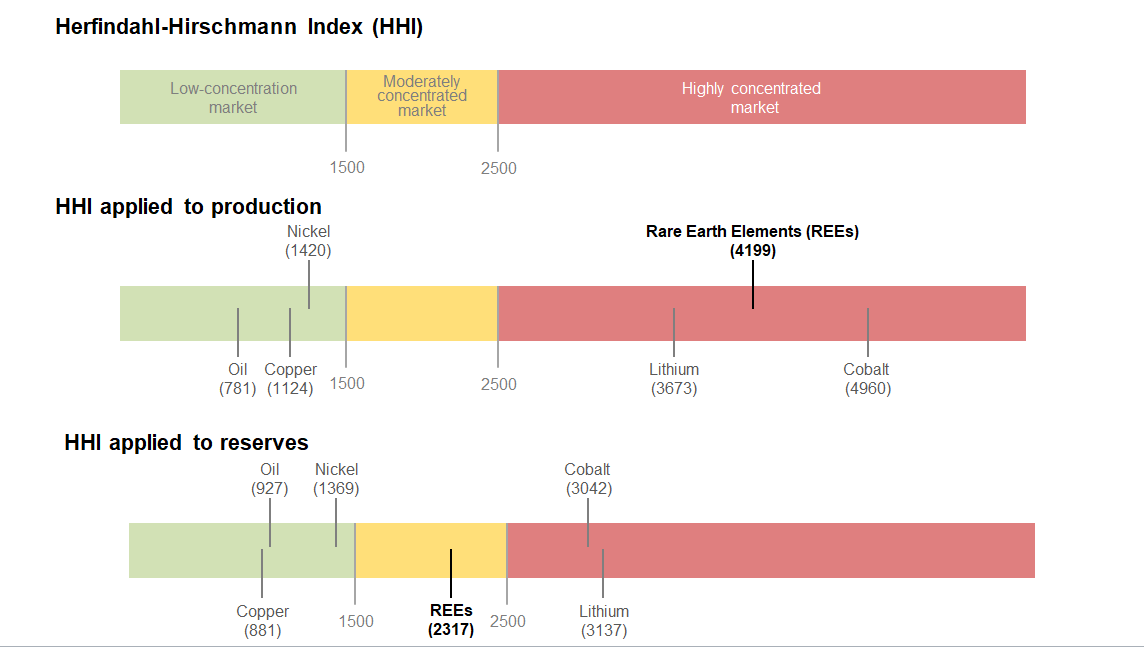

Mining production of rare earths has almost tripled in 25 years, increasing from 80,000 tons in 1995 to 213,000 tons in 2019, and is characterized by a high level of concentration (HHI of 4,199). China largely dominates production (62%), followed by the United States (12%) and Myanmar (10%), a new market entrant.

With the exception of China, the leading positions do not reflect the distribution of reserves (120 million tons according to USGS estimations) which are more than three-quarters held by only three countries – China, Brazil and Vietnam – but are not as concentrated as rare earth mining production (HHI of 2,317). Significant reserves are also recorded in Russia and India.

Source: USGS

Originally pioneers in the field, the United States and Australia relinquished leadership to China in 1988 and then disappeared from the list of rare earth producing countries in the late 1990s. The trend of decline was fast, as in 1995, the United States was still a major player in the field with 28% of world production. The two countries have only made their comeback in the very early 2010s.

In recent years, the sector has been transformed. This has been made possible, in particular, by the resurgence of exploration projects in the early 2010s, in a context where a shortage of rare earths on the global market was feared. Resources containing 98 million tons of rare earth oxide equivalent have been identified in Canada, Greenland and four African countries (Kenya, Tanzania, Malawi, South Africa) (Paulick and Machacek, 2017).

Burundi entered the rare earths market in 2018, becoming the first – and so far only – producer of these elements on the African continent. As shown by the extravagant purchase proposal made by the Trump administration to Denmark, Greenland is coveted by the United States and could help diversify sources of rare earths supply. In June 2019, the U.S. State Department announced a collaboration with the Greenland Ministry of Mineral Resources and Labor to boost investment and mineral exploration in the Gadar Province, a high potential area for several metals, including the rare earth elements family.

Despite significant reserves, other countries (Canada, Vietnam, Kenya and Brazil) still contribute only marginally, if at all, to this market (USGS, 2020).

How can this situation be explained? Extraction and separation of rare earths are technically challenging and extremely polluting activities, and require large quantities of water. As a result, US and European companies have gradually abandoned them to the benefit of China, which, in order to impose itself on this market, has built its competitive advantage on large reserves but also and above all on cheap labor and environmental standards that have not been very restrictive since the end of the 1980s.

Why is there so much talk about rare earths?

Like other metals (cobalt, copper, etc.) which are expected to play an increasing role in policies to combat global warming, the consumption of rare earths is driven by the use of low-carbon technologies (first and foremost the permanent magnets of offshore wind turbines).

Against this backdrop, the question of the geological criticality of rare earths arises – will resources be sufficient to cover future needs? – but also that of the security of supply for consuming countries (the United States, Europe and Japan in the lead) with regard to geo-economic issues and environmental impacts.

An absence of geological urge in demand

To quantify the future needs for rare earths related to the energy transition, the IFPEN Economics and Environmental Assessment Department team used the TIAM-IFPEN model. Two climate scenarios were defined:

- a 4°C scenario corresponding to a temperature rise of 4°C above pre-industrial levels (scenario 4D);

- a more ambitious climate scenario in line with a temperature increase limited to 2°C (scenario 2D).

With a 4°C scenario, 1,800 GW of additional variable renewable energy (VRE) capacity is to be installed by 2050. In the case of more stringent climate policies, 25,600 GW of additional RE capacity is needed, including 8,124 GW of onshore wind and 4,065 GW of offshore wind. Considering that one kilogram of permanent magnets can contain up to 32% neodymium and 6% dysprosium (ADEME, 2020), it is feared that resources will be insufficient to meet the anticipated increase in demand

The needs generated by these additional capacities were then compared to the identified resources (137 million tons). It is important to underline that the resources considered in our model concern all the 17 elements constituting the rare earths family. However, some rare earths are less abundant than others. A distinction is thus made between light rare earths produced in larger quantities (neodymium for example) and heavy rare earths (including dysprosium and terbium), which have a higher market value because their low grades in ores make them more difficult to produce (ADEME, 2020).

In line with the expected increase in nameplate capacity, the results show an almost 2.5-fold increase in total rare earths consumption in a 4°C scenario and a more than 10-fold increase in a 2°C scenario by 2050. China would remain the world's largest consumer, followed by Japan, the United States and Europe.

Yet, despite this surge in demand, none of the modeling scenarios considered mentions a risk of resource depletion. The ratio between the cumulative consumption of rare earths between 2005 and 2050 and the resources observed in 2017 is 1.6% for the 4°C scenario and 3.8% for the 2°C scenario, which leaves a significant margin of security of supply (98.4% and 96.2% respectively for the two scenarios). In other words, despite a name that seems to call for caution, no geological pressure seems to be to be feared for rare earth resources in the decades to come, unlike copper or cobalt. Nevertheless, one should bear in mind that a disaggregation of the rare earths family would certainly reveal geological criticalities. This work is ongoing and the availability of data will be one of the critical points.

The calculation of the margin of security of supply having been made in relation to all rare earth resources taken together, this result nevertheless needs to be commented on. Indeed, heavy rare earths are geologically more critical than light rare earths and they are almost exclusively produced in China. A strong demand for a heavy rare earth element could therefore lead to increased pressure on the resources of this specific element.

Source: IFPEN

A rare earths market under threat?

These results may seem surprising in regard to the strong media coverage of rare earths over the last decade. The reasons for the concern associated with these metals need to be clarified: it seems that their security of supply is more threatened by China's extensive involvement in the value chain and by the environmental constraints linked to mining and processing operations.

China's domination of the value chain

To cope with the surge in domestic demand for rare earths and in response to the growing environmental and health problems caused by their exploitation, China introduced export restrictions in 2010. That same year, China also suspended shipments of rare earths to neighboring Japan due to a diplomatic crisis related to territorial issues1.

These events led to the filing of a complaint to the WTO by the United States, Europe and Japan, which denounced these measures, which, they claim, are designed to favor Chinese companies located downstream in the value chain2. The market response was not long in coming: prices soared and, anticipating opportunities for significant future gains, exploration projects and the opening or reopening of mining sites proliferated (Mountain Pass in California, Mount Weld in Australia). As a result, investments in the mining exploration sector were multiplied by 18 between 2009 and 2010 (Cox and Kynicky, 2018).

The ''rare earths crisis'' has highlighted the danger posed by the concentration of production in Chinese hands, which at the time accounted for more than 97% of mining extraction, and the growing weight of Chinese consumption in global volumes.

From being a supplier to the world, China has now become the main consumer of rare earths (Seaman, 2019). With a growing demand, Chinese companies are now seeking to secure their supplies from foreign mines. As a result, China is expected to become a major importer of rare earths in the coming years, thereby changing its position and influence in the value chain. The introduction of more stringent environmental standards is expected to further restrict the quantities available to other market players. The modeling exercise carried out by IFPEN's teams confirms the persistence of this risk on future supply: whatever the scenario envisaged, China should remain the leading producer and consumer by 2050.

The example of the rare earths crisis in 2010 is a good illustration of the impact of market trends in the United States and Japan on the diversification of supply sources. While the post-crisis climate was conducive to investment in the rare earths sector, the anticipated shortage of supply did not materialize and the drop in prices observed in 2013 brought many projects to a sudden halt.

Although rare earths have become a growing concern for states dependent on Chinese imports (with the United States, Australia and Japan leading the way), the pace of development of exploration and extraction projects remains dependent on raw material prices and China's market strategy. This is the case, for example, of the Kipawa mine in Quebec, whose start-up has been on the agenda for several years but has not yet been launched. More recently, the "rare earths problem" has been brought back to the fore with the trade war between the United States and China.

While China's weight in world production has declined since 2010 (from 97% of world production at that time to 62% in 2019), its influence has not been limited to the upstream end of the value chain. Beijing has a near-monopoly in the separation of rare earths and the production of intermediate products.

The Moutain Pass site in the United States is an emblematic example of its dependence on China for highly technical activities: all of the extracted elements are shipped to China for processing and separation. This mine was also acquired by the MP Mine Operations consortium in which the Chinese company Shenghe Resources Holding Co holds a share of just under 10%3. Projects designed to compete with the Chinese domination in this field are underway but are not yet operational (e.g. the partnership between the Australian Lynas Corp and the Texan company Blue Line for the construction of a heavy rare earth separation plant).

China also aims both to invest more downstream in the value chain and to limit the growing environmental impact of its mining activities, which could strengthen its desire to reserve its domestic production for its industry. This strategy has resulted in a sharp rise in the pace of patent filings since 2011, as well as a move to group together entities in the mining sector into six State-owned enterprises (SOEs). Between 1950 and October 2018, China filed 25,911 patents related to rare earths, compared to 9,810 for the United States, 13,920 for Japan and 7,280 for the European Union. China’s patent filing rate has increased dramatically since 20114.

Lastly, driven by an ambitious industrial policy, China has invested in the RE sector, and in particular the wind turbine market with its national champion Goldwind. Through its proactive industrial strategy, China has integrated the entire value chain of rare earth minerals, from permanent magnets to companies exporting low-carbon technologies.

Water, a limiting factor for the rare earths industry?

The rare earths industry requires large quantities of water. However, this consumption is expected to grow along with the supply of rare earths, especially in a 2°C scenario. The results highlight increased pressure on water resources in at least two countries already subject to high water stress: China and Australia.

In a 2°C scenario, the water consumption generated by the Australian rare earths industry in 2050 would account for more than twice the water consumption generated by all industrial sectors in 2015, i.e. 25.5% of the total volume of water withdrawn in the country in 2015. However, rare earths are not the only consideration in Australia's proactive mining policy. Australia is developing its mining activities for other key metals of the energy transition, such as cobalt and lithium. Although less alarming, the situation is similar for China.

This raises the question of the sustainability of the energy transition with regard to the resources on which it relies directly – the metals – or indirectly – the increased needs for water and energy.

Rare earths and the environment: what might China consider?

The environmental issue has also become a real concern for China. For several years, the notion of "ecological civilization" has been at the heart of the rhetoric of the Chinese Communist Party. This concept was born in response to the growing antagonism between, on the one hand, a growth model that has enabled China to emerge from poverty and impose itself on the international scene and, on the other hand, the growing risk of internal destabilization of the regime caused by the environmental and health externalities created by this very model. The Chinese authorities are working hard to address air pollution, a widely publicized subject, but they are also tackling the crisis of natural ecosystems, and more specifically the issue of water and soil contamination (Hache, 2019; Hache et al., 2020).

As regards rare earths, the importance of illegal production, the insufficient level of innovation and excess production capacity, coupled with the weakness of legal and regulatory mechanisms concerning the environmental impact of this industry, are causing terrible environmental and health damage to the country and its population (Seaman, 2019).

It seems more than uncertain that China will continue to bear the negative externalities of this industry while sharing the benefits, i.e. cheap rare earths production. Also, a future tightening of environmental standards related to this sector is more than likely and what has been interpreted as a demonstration of power (i.e. the use of rare earths as a diplomatic weapon) can be expected to be repeated in the future.

1 Le Figaro, Mathilde Golla, ”La Chine prive le Japon de métaux rares”: https://www.lefigaro.fr/conjoncture/2010/09/24/04016-20100924ARTFIG00274-la-chine-utilise-les-metaux-rares-pour-faire-pression.php

2 World Trade Organization: https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds431_e.htm

3 Reuters, Ernest Scheyder, 23 August 2019, “California rare earths miner races to refine amid U.S.-China trade row”: https://www.reuters.com/article/us-usa-rareearths-mpmaterials/california-rare-earths-miner-races-to-refine-amid-u-s-china-trade-row-idUSKCN1VD2D3

4 Ng, E., (2019), “China’s war chest of rare earth patents give an insight into total domination of the industry”, South China Morning Post, https://www.scmp.com/business/companies/article/3019290/chinas-war-chest-rare-earth-patents-give-insight-total

Points to remember

The consumption of rare earths, metals with remarkable properties that have become essential for many sectors, should be partly driven by low-carbon technologies, in particular by the use of permanent magnets in wind turbines. The solar photovoltaic and battery sectors consume little or no rare earths.

Unlike copper or cobalt, which are also set to play an increasing role in policies to fight against global warming, the risks to rare earths of all types are less geological but rather:

- geostrategic: China dominates the entire value chain, from mineral production to the separation of rare earths and the production of intermediate products;

- economic: the global market for rare earths depends on China's consumption, production and export strategy;

- environmental: the extraction and separation of rare earths require large quantities of water. China's environmental challenges and the resulting tightening of regulations could also restrict supply by 2050.

To find out more

Metals in the energy transition

Find all the points on this video:

>> BIBLIOGRAPHY

Scientific contacts : Emmanuel Hache, Charlène Barnet, Gondia Seck

To quote from this article: Hache, Emmanuel ; Barnet, Charlène ; Seck, Gondia-Sokhna «Rare earths in the energy transition: what threats are there for the “vitamins of modern society”?», Metals in the energy transition, n° 3, IFPEN, January 2021.