In 2016, IFP School joined forces with Mines ParisTech, Toulouse School of Economics and Paris Dauphine-PSL University to launch an original scientific initiative: the ”Economics of Natural Gas” Chair.

The creation of this Chair resulted from a series of observations concerning the scientific and societal relevance of questions related to gas (particularly in the context of the energy transition and the rapid development of new technologies) and the opportunities offered by the complementary nature of the expertise present.

Accordingly, the chair set itself the following objectives:

- to advance scientific knowledge in energy economics on gas issues;

- to support an ambitious research program, the results of which are intended to be published in top-field journals;

- to empower talented researchers by providing them with the opportunity to broaden their research practice and to facilitate their presence in international networks;

- to educate the next generation of energy economists and experts by developing a set of modernized courses on contemporary gas issues.

Supported by industry (EDF, GRTGaz and Total) via the Fondation des Mines, the Chair has a lean organizational structure and a governance that complies with international academic standards. Identification of the themes tackled and evaluation of the research carried out are overseen by an independent scientific committee that gathers a group of eminent scholars1.

To date, the Chair has initiated five doctoral projects.

Four of these PhD dissertations have just been defended and offer a series of original contributions on various issues including:

- the spatial integration of gas markets2;

- the flexibility of the gas supply chain3;

- the econometrics of energy demand4;

- and the application of network theory to model the transition to low-carbon societies5.

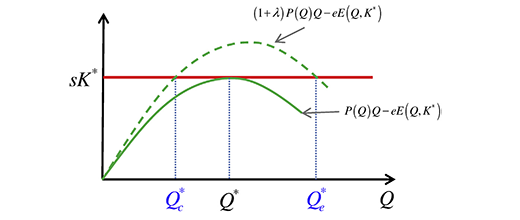

In parallel, the Chair's researchers have also worked on a range of other themes, such as the technical and economic representation of gas transport, the behavior of regulated operators (figure) and the detection of market power in a liberalized gas industry.

subject to an increase in demand [3]

The solid line depicts the situation envisaged in the absence of an increase: the volume Q* is such that the book profit (in green) reaches the authorized level of capital remuneration (red constraint).

The dotted line depicts the situation given an increase in demand: satisfying the regulation constraint requires a production adjustment either up (expansion to Qe) or down (contraction to Qc).

The Chair also organized two international conferences in Paris and invited foreign scholars to lead dedicated seminars. So far, the research conducted at the Chair has resulted in 14 scientific publications (e.g., [1-4]) and more than fifty papers at conferences and academic seminars.

For IFPEN, the momentum created by the Chair directly contributes to advances in the fundamental research conducted within the context of Scientific Challenge No. 9 “Assessing the economic and environmental challenges of the energy transition”.

At IFP School, the initiatives promoted by the Chair have made it possible to modernize the teaching of energy economics and thus better prepare students for current and upcoming challenges. For example, they now get some exposure to the modern tools and methodologies (based on game theory concepts, for instance) required to model and analyze price formation in a network industry in the presence of imperfect competition. The Chair also made it possible to develop new case studies inspired by contemporary industrial issues and energy policy debates.

Future research developments will concentrate on a variety of issues, such as the market design needed to foster the efficient coordination of low-carbon electricity and gas systems or the barriers hampering the deployment of new, gas-based, energy technologies. Research targeting these areas will primarily be hinged around the implementation of methodological developments initiated over the last four years.

1-The scientific board consists of Professors Steven A. Gabriel (University of Maryland), Christian von Hirschhausen (TU Berlin and DIW (the German Institute for Economic Research)), Michele Polo (Bocconi University) and Robert Ritz (University of Cambridge, Chairman of the Board).

2- Ekaterina Dukhanina (2020), “Integration of gas markets : Europe and beyond”. Thesis defended at MinesParisTech.

3- Amina Baba (2020), “La flexibilité sur le marché du gaz naturel ” (Natural Gas Market Flexibility). Thesis defended at Paris-Dauphine University.

4- Arthur Thomas (2020), “La demande de gaz naturel dans la transition énergétique” (The Demand for Natural Gas in the Energy Transition). Thesis defended at Nantes University.

5- Côme Billard (2020), “Connections Vertes : Appliquer l'Economie des Réseaux à la Transition Energétique ” (Green Connections: Applying Network Economics to the Energy Transition). Thesis defended at Paris-Dauphine University.

[1] A. Thomas, O. Massol, B. Sévi (2021). How are day-ahead prices informative for predicting the next day’s consumption of natural gas? Evidence from France. The Energy Journal, (Accepted & Forthcoming).

>> DOI: 10.2139/ssrn.3388794

[2] A. Baba, A. Creti, O. Massol (2020). What can be learned from the free destination option in the LNG imbroglio? Energy Economics, Vol. 89: 104764.

>> DOI: 10.1016/j.eneco.2020.104764

[3] F. Perrotton, O. Massol (2020). Rate-of-return regulation to unlock natural gas pipeline deployment: Insights from a Mozambican project. Energy Economics, 85, 104537.

>> DOI: 10.1016/j.eneco.2019.104537

[4] O. Massol, A. Banal-Estañol (2018). Market Power and Spatial Arbitrage between Interconnected Gas Hubs. The Energy Journal, Vol. 39 (SI2), 67-95.

>> DOI: 10.5547/01956574.39.SI2.omas

Scientific contact: Olivier Massol